What is Ambiguity effect?

The ambiguity effect is the tendency to avoid options whose probability of a favorable outcome is unknown, even when the expected value is comparable to or better than a known alternative. It is closely related to ambiguity aversion but focuses specifically on how ambiguity distorts choice between options.

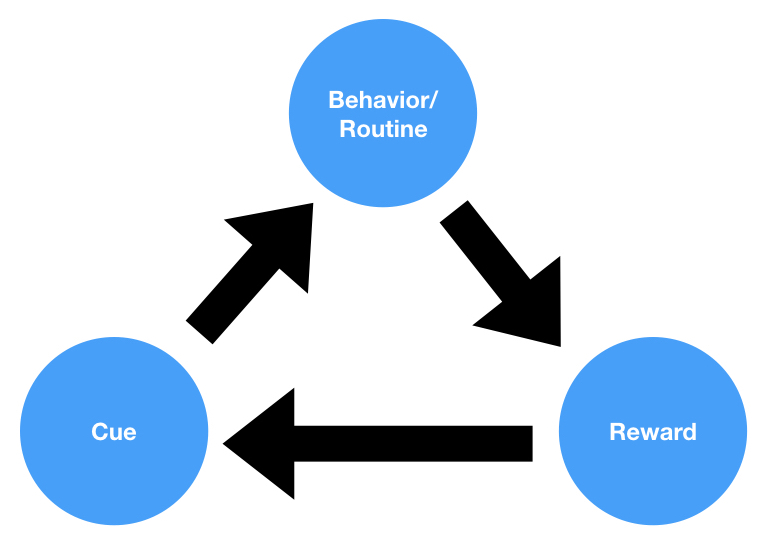

How it works

In experiments, participants consistently choose a bag with a known 50/50 mix of red and black balls over a bag with an unknown mix, even when told the unknown bag could have better odds. The effect intensifies when the stakes are higher and when people feel less competent to assess the ambiguous option. It drives preference for familiar brands, established technologies, and domestic investments.

Applied example

A patient choosing a well-studied medication with a known 60% success rate over a newer treatment with a success rate somewhere between 40% and 90% is exhibiting the ambiguity effect: the uncertainty about the range feels riskier than the known moderate probability.

Why it matters

The ambiguity effect explains why new products, unfamiliar markets, and novel policies face adoption resistance beyond what their objective merits would predict.